(IAB members only)

(IAB members only)

– Banners in social media up 36% to £134.2m

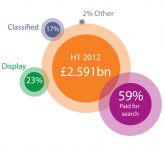

– FMCG joins Finance as biggest digital display advertiser – accounting for nearly one third combined Despite the difficult UK economy, advertising on the internet and mobile phones increased, like-for-like*, by 12.6% to a record six-month high of £2.59 billion in the first half of 2012– up by over £294 million from £2.30 billion in the first half of 2011, according to the latest Internet Advertising Bureau UK (IAB) advertising expenditure report, conducted by PwC.

Digital advertising formats

Display advertising across the internet and mobile, boosted by the increase in video and banners in social media, grew by 10.6% year-on-year on a like-for-like basis to £590.9 million from £534.7 million, representing a 23% share of digital ad spend in the first half of 2012.

Digital video advertising increased 43% to £69.8 million from £49.0 million, accounting for 12% of online and mobile display in the first six months of 2012; the equivalent share was 9% in the same period in 2011. Banners in social media environments increased 36% to £134.2 million, accounting for 23% of display ad spend, up from 19%.

Paid-for search marketing continues to thrive due to its transparent and measurable nature, appealing during these budget-pressured times. Year-on-year, search increased 15.9% on a like-for-like basis to £1,527 million from £1,318 million – representing a 59% share of digital advertising.

Classifieds grew 7.2% like-for-like to £427.1 million from £391.5 million – accounting for 16% of digital ad spend in the first half of 2012. Recruitment classifieds showed encouraging growth, at 149.8 million in H1 2012 compared to 135.4 million in H2 2011 – up 11% – their highest level since the first half of 2008.

Mobile’s meteoric rise continues

Fuelled by smartphone ownership hitting 58%** of the UK population in June 2012, mobile advertising continued its meteoric rise, growing like-for-like by 132% to £181.5 million in the first half of 2012. Mobile now accounts for 7% of all digital ad spend.

Display, video, SMS and MMS advertising on mobiles increased like-for-like by 91% to £49.9 million whilst mobile search grew like-for-like by 152% to £131.6 million – accounting for 72% of mobile ad spend.

Amongst media owners who submitted revenue figures to the IAB and PwC, ad spend on tablets is estimated to be at least £2.4 million in the first half of 2012.

Tim Elkington, Director of Research & Strategy at the Internet Advertising Bureau, says: “Almost 60% of people in the UK have a smartphone, average UK household broadband speed is now 9MB and social media accounts for one fifth of all internet time. As digital technology and services evolve to make consumers’ lives easier, more connected and more fun, it’s no surprise that advertisers are coming to the digital party with bigger budgets, despite the challenging economic times elsewhere.

“However, there’s still plenty of room for growth. Take mobile; 60% of the UK’s 100 biggest advertisers still don’t have a mobile-optimised website yet consumers spend almost 70% longer on sites which are. If all advertisers get wise to this, we’re likely to see significant mobile growth for some time yet.”

FMCG joins finance as top advertiser category

The consumer goods (FMCG) sector joins the finance sector as the biggest spender on digital display advertising – both accounting for almost 16% of display ad spend in the first half of 2012. FMCG’s share has almost doubled in the last three years – from 9% in the first half of 2009 – as marketers realise digital’s power in delivering brand awareness, particularly as part of ad campaigns involving other media such as TV and print.

The five top display sectors between January and June 2012 are completed by entertainment & media (13%), retail (11%) and travel & transport (10%).

Anna Bartz, Senior Manager at PwC, said: “For the first time since we started measuring Digital Adspend, consumer goods (FMCG) advertisers have joined the long-time leader, Financial Services at the top of the spending charts. Interestingly, spend by FMCG advertisers increased across all digital channels, reflecting advertisers’ recognition of online and mobile as brand building platforms.”

*Methodology for like-for-like reporting:

To provide the most accurate like-for-like growth rates, only companies that submitted in H1 2011 and H1 2012 have been included in year-on-year growth calculations.

**Source: IAB UK comScore, MobiLens, UK, 3 month average ending June 2012